HEALTH NET,

INC.

NOTICE OF

20102012 ANNUAL

MEETING

AND

PROXY

STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material |

HEALTH NET, INC.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

HEALTH NET,

INC.

NOTICE OF

20102012 ANNUAL

MEETING

AND

PROXY

STATEMENT

April 21, 20106, 2012

Dear Stockholders:

It is a pleasure to invite you to attend the 20102012 Annual Meeting of Stockholders of Health Net, Inc. to be held at 21281 Burbank Boulevard in Woodland Hills, California 91367 on Wednesday,Tuesday, May 12, 2010,22, 2012, at 10:00 a.m. (Pacific Time). For your convenience, we are offering a live webcast of the Annual Meeting on our Internet Web site,website,www.healthnet.com.

Each item of business described in the accompanying Notice of Annual Meeting and Proxy Statement will be discussed during the Annual Meeting. In addition, a report on our business operations will be presented at the Annual Meeting. Stockholders who attend the Annual Meeting will have an opportunity to ask questions at the meeting. Those who participate in the live webcast may submit questions during the meeting via the Internet.

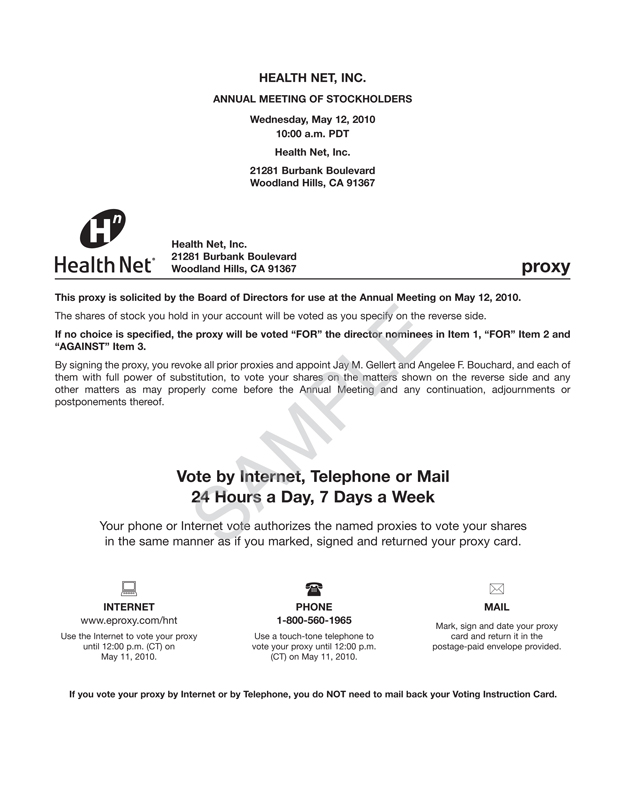

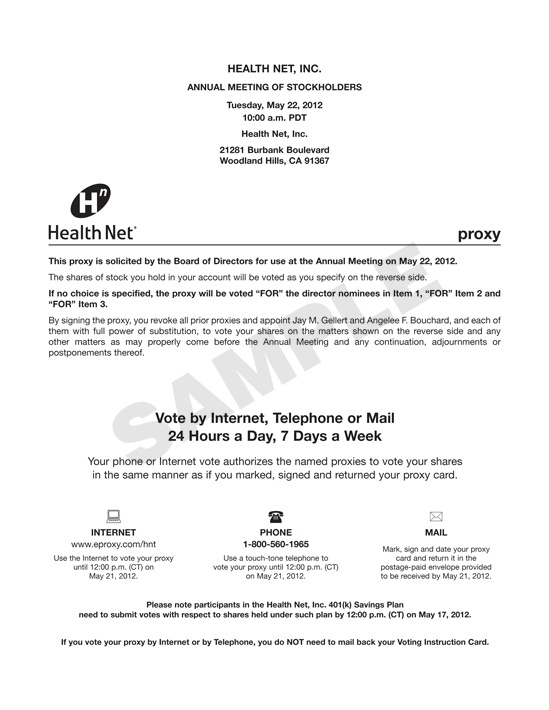

It is important that you vote your shares whether or not you plan to attend the Annual Meeting. We urge you to carefully review the proxy statement and to vote your choices either on the enclosed proxy card, by telephone or via the Internet. You may return your proxy card by mail by using the enclosed self-addressed, postage-paid envelope. If you choose this method, please sign and date your proxy card and return it as soon as possible. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hnt.hnt. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail. If you do attend the Annual Meeting in person, your proxy can be revoked at your request.

We look forward to your attendance at the Annual Meeting.

Sincerely,

Jay M. Gellert

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Health Net, Inc. will hold its 20102012 Annual Meeting of Stockholders on Wednesday,Tuesday, May 12, 201022, 2012 at 10:00 a.m. (Pacific Time) at 21281 Burbank Boulevard in Woodland Hills, California 91367, for the following purposes:

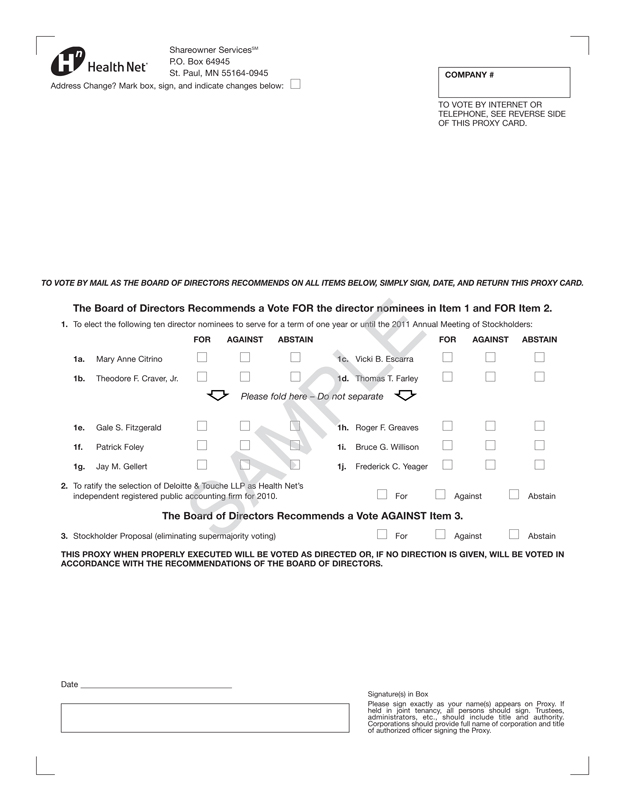

| 1. | To elect the following |

| 2. | To ratify the selection of Deloitte & Touche LLP as Health Net’s independent registered public accounting firm for |

| 3. | To |

| 4. | To transact such other business as may be properly brought before the meeting or any continuation, adjournments or postponements thereof. |

The Board of Directors has fixed Wednesday, March 31, 2010,28, 2012, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any continuation, adjournments or postponements of the Annual Meeting.

At the Annual Meeting, each share of Common Stock, $.001 par value per share, of Health Net represented at the Annual Meeting will be entitled to one vote on each matter properly brought before the Annual Meeting. Jay M. Gellert and Angelee F. Bouchard have been appointed as proxy holders, with full rights of substitution, for the holders of Common Stock.

By Order of the Board of Directors,

Angelee F. Bouchard

Senior Vice President, General Counsel and

Secretary

April 21, 20106, 2012

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the 20102012 Annual Meeting of Stockholders of Health Net, Inc. in person. However, to ensure your representation at the Annual Meeting, please mark, sign and date the enclosed proxy card and return it as soon as possible in the enclosed self-addressed, postage-paid envelope. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hnt. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail. If you attend the Annual Meeting in person, you may vote at the meeting even if you have previously returned a proxy.

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 11 | ||||

| 14 | ||||

| 25 | ||||

| 25 | ||||

| 28 | ||||

| 28 | ||||

Report of the Compensation Committee of | 48 | |||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

Narrative to Summary Compensation Table and Plan-Based Awards Table | 53 | |||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 64 | ||||

Security Ownership of Certain Beneficial Owners and Management | 66 | |||

| 70 | ||||

Report of the Audit Committee of the Board of Directors of Health Net, Inc. | 73 | |||

Principal Independent Registered Public Accounting Firm Fees and Services | 74 | |||

| 75 | |||

| 76 | ||||

Stockholder Proposals for the | 78 | |||

| 79 | ||||

| 80 | ||||

FOR THE 20102012 ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD

MAY 12, 2010May 22, 2012

MEETING AND VOTING INFORMATION

General

The accompanying proxy is solicited by the Board of Directors of Health Net, Inc. (“Health Net,” “we,” “us” or “our”) for use at our 20102012 Annual Meeting of Stockholders (the “Annual Meeting” or “2010“2012 Annual Meeting”) to be held on Wednesday,Tuesday, May 12, 201022, 2012 at 10:00 a.m. (Pacific Time) at 21281 Burbank Boulevard, Woodland Hills, California 91367, and at any continuation, adjournments or postponements thereof. Directions to attend the meeting can be found on our Internet Web site,website,www.healthnet.com.1 We expect to mail this proxy statement and accompanying proxy card beginning on or about April 21, 20106, 2012 to all stockholders entitled to vote at the Annual Meeting. In this proxy statement, unless the context otherwise requires, the terms “Company,” “Health Net,” “we,” “us,” and “our” refer to Health Net, Inc. and its subsidiaries.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 12, 201022, 2012

This proxy statement, including a proxy card sample, the notice of the Annual Meeting and our 20092011 Annual Report on Form 10-K are available on our Internet Web sitewebsite address athttp://www.healthnet.com/InvestorRelations/2010Proxy.2012Proxy This Web site address contains the following documents: the notice of the Annual Meeting, this proxy statement, including a proxy card sample, and the 2009 Annual Report on Form 10-K.. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

We are offering a live webcast of the Annual Meeting on our Internet Web site,website,www.healthnet.com. The webcast of the Annual Meeting will consist of live sound, real-time access to printed material and the ability of stockholders to submit questions during the question and answer period. To participate in the webcast of the Annual Meeting, a stockholder should log on towww.healthnet.com on Wednesday,Tuesday, May 12, 201022, 2012 shortly before 10:00 a.m. (Pacific Time) and follow the instructions provided under the “Investor Relations” section of the Web site.website. Stockholders willnot be permitted to vote over the Internet during the Annual Meeting.

Who Can Vote; Outstanding Shares

Only holders of record of our Common Stock, $.001 par value per share (“Common Stock”), at the close of business on March 31, 201028, 2012 (the “Record Date”) are entitled to vote at the Annual Meeting. Each share of Common Stock represented at the Annual Meeting is entitled to one vote on each matter properly brought before the Annual Meeting. As of the Record Date, we had outstanding 100,216,66983,241,450 shares of Common Stock.

In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting, and for 10 days prior to the Annual Meeting in the Investor Relations department at our corporate office at 21650 Oxnard Street, Woodland Hills, California 91367, between the hours of 9:00 a.m. and 4:00 p.m. (Pacific time).

Quorum and Votes Required

Our bylaws require that the holders of a majority of the total number of shares entitled to vote be present in person or by proxy in order for the business of the Annual Meeting to be transacted. Abstentions and “broker non-votes” will be counted as present for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. “Broker non-votes” occur when a bank, broker or other nominee holding shares for a beneficial owner does not vote those shares on a particular proposal because it does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Participation by a stockholder in the live webcast of the Annual Meeting will not be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

Stockholder approval of each proposal requires the following votes:

| • |

|

| • |

|

| • |

|

Voting by Proxy

If you hold your shares of Common Stock as a record holder, you may vote by specifying your choices by marking the appropriate spaces on the enclosed proxy card, signing and dating the card and returning it in the enclosed self-addressed, postage-paid envelope.envelope to be receivedby Monday, May 21, 2012. Alternatively, you may vote your shares by telephone by calling 1-800-560-1965, or over the Internet athttp://www.eproxy.com/hntbefore 12:00 p.m. (Central Time) on Monday, May 11, 201021, 2012. If you vote by telephone or over the Internet, your electronic vote authorizes the named proxies in the same manner as if you returned a signed and dated proxy card by mail.Voting over the Internet or telephone will not be permitted after 12:00 p.m. (Central Time) on Tuesday,Monday, May 11, 2010.21, 2012.

Note that if you hold shares of Common Stock in the Health Net, Inc. 401(k) Savings Plan (the “401(k) Plan”), you may vote your shares by telephone or by Internet as described above, but your voting instructions must be receivedbefore 12:00 p.m. (Central Time) on Thursday, May 17, 2012in order for the 401(k) Plan trustee to vote your shares.

Instructions on how to submit a proxy via the Internet and telephone are located on the attachment to the proxy card included with this proxy statement. The Internet and telephone voting procedures are designed to authenticate our stockholders by use of a control number located on the attachment to the proxy card included herewith. If you hold your shares through a bank, broker or other nominee, check the instructions provided by that entity to determine which voting options are available to you. Please be aware that any costs related to voting over the Internet, such as Internet access charges, will be your responsibility.

All properly signed proxies that are received before the polls are closed at the Annual Meeting and that are not revoked will be voted at the Annual Meeting according to the instructions indicated on the proxies or, if no direction is indicated, they will be votedvoted:

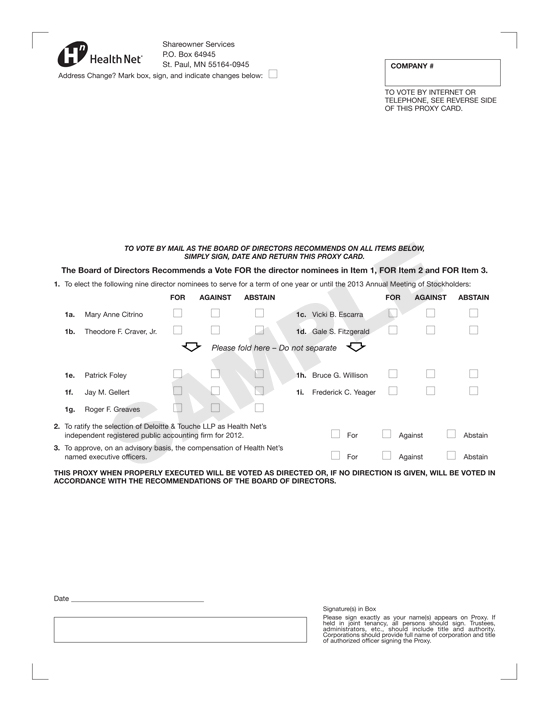

“FOR”proposals 1 and 2, and “AGAINST”FOR proposal 3 if it is properly presented at the election of the nine nominees listed in this proxy statement to serve on our Board of Directors for a term of one year or until the 2013 Annual Meeting.Meeting of Stockholders;

FOR the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2012; and

FOR the approval, on an advisory basis, of the compensation of our named executive officers, as described in this proxy statement.

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and any continuation, adjournments or postponements thereof.

Voting in Person

If you are a stockholder of record and plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee, and you wish to vote in person at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record holder of the shares (your broker or other nominee) authorizing you to vote at the Annual Meeting.

Stockholders who wish to attend the Annual Meeting will be required to present verification of ownership of our common stock,Common Stock, such as a bank or brokerage firm account statement and will be required to present a valid government-issued picture identification, such as a driver’s license or passport, to gain admittance to the Annual Meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Revocability of Proxies

Any stockholder giving a proxy has the power to revoke it at any time before the proxy is voted at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any of the following three ways:

| (1) | By delivering, before 6:00 p.m. (Central Time) on Monday, May 21, 2012, to our Corporate Secretary (at our executive offices at 21650 Oxnard Street, Woodland Hills, California 91367) a signed written notice of revocation bearing a later date than the proxy, stating that the proxy is |

| (2) | By duly executing a subsequently dated proxy relating to the same shares of Common Stock and delivering it to our Corporate Secretary or submitting it by telephone by calling 1-800-560-1965, or electronically via the Internet athttp://www.eproxy.com/hntbefore 12:00 p.m. (Central Time) on Monday, May |

| (3) | By attending the Annual Meeting in person and voting such shares during the Annual Meeting, although attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If you hold shares of Common Stock in the 401(k) Plan, you may revoke your proxy using any of the above three methods, but must do sobefore 12:00 p.m. (Central Time) on Thursday, May 17, 2012.

If your shares are held by a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so.

Solicitation

Our Board of Directors is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of the solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy and any additional materials furnished to stockholders. Proxies may be solicited by directors, officers and a small number of our regular employees personally or by mail, telephone or telegraph,facsimile, but such persons will not be specially compensated for such service. We have retained MacKenzie Partners, Inc. to assist in the solicitation

of proxies for a fee of approximately $15,000$10,000 plus reasonable out-of-pocket costs and expenses. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians that hold shares of our Common Stock of record for beneficial owners for forwarding to such beneficial owners. We may also reimburse persons representing beneficial owners for their costs of forwarding the solicitation material to such owners.

Assistance

If you need assistance in completing your proxy card or have questions regarding the Annual Meeting, please contact our Investor Relations department at (800) 291-6911.1-800-291-6911.

Your vote is important. Please sign, date and return a proxy card (or vote your shares over the Internet or by telephone) promptly so your shares can be represented, even if you plan to attend the Annual Meeting in person. The voting results will be included in a Current Report on Form 8-K filed within the time required by the SEC.

We are an integrateda publicly traded managed care organization that delivers managed health care services through health plans and government-sponsored managed care plans. Our mission is to help people be healthy, secure and comfortable. We operate and conduct our businesses through subsidiaries of Health Net, Inc., which is among the nation’s largest publicly traded managed health care companies. In this proxy statement, unless the context otherwise requires, the terms “Company,” “Health Net,” “we,” “us,” and “our” refer to Health Net, Inc. and its subsidiaries.

Our health plansWe provide and government contracts subsidiaries provideadminister health benefits through our health maintenance organizations (“HMOs”), insured preferred provider organizations (“PPOs”), point-of-service (“POS”) and indemnity plans to approximately 6.16.0 million individuals across the country through group, individual, Medicare, (including the Medicare prescription drug benefit commonly referred to as “Part D”), Medicaid, U.S. Department of Defense, including TRICARE, and Veterans Affairs programs. Our behavioral health services subsidiary, Managed Health Network, Inc. (“MHN”), provides behavioral health, substance abuse and employee assistance programs to approximately 6.55.0 million individuals, including our own health plan members. Our subsidiaries also offer managed health care products related to prescription drugs and offer managed health care product coordination for multi-region employers and administrative services for medical groups and self-funded benefits programs. In addition, we own health and life insurance companies licensed to sell PPO, POS and indemnity products, as well as auxiliary non-health products such as life and accidental death and dismemberment, dental, vision, behavioral health and disability insurance, including our Medicare Part D Pharmacy coverage under Medicare.

We were incorporated in 1990. Our current operations are the result of the April 1, 1997 merger transaction (the “FHS Combination”) involving Health Systems International, Inc. (“HSI”) and Foundation Health Corporation (“FHC”). We changed our name to Health Net, Inc. in November 2000. Prior to the FHS Combination, we were the successor to the business conducted by Health Net of California, Inc., now our HMO subsidiary in California, and HMO and PPO networks operated by QualMed, Inc. (“QualMed”), which combined with us in 1994 to create HSI.

The mailing address of our principal executive office is 21650 Oxnard Street, Woodland Hills, CA 91367, and our Internet Web sitewebsite address iswww.healthnet.com.

PROPOSALITEM 1—ELECTION OF DIRECTORS

General; Board Structure

Our certificate of incorporation provides for directors to be elected on an annual basis. Under our certificate of incorporation and bylaws, the Board of Directors will consist of between three and twenty members, with the exact number to be fixed from time to time by the Board of Directors. The number of members constituting the Board of Directors has been fixed by the Board of Directors at twelve.

Ournine and our Board of Directors currently consists of tennine members. Assuming the election of each of the director nominees at the Annual Meeting, the Board of Directors will continue to consist of tennine members.

Our bylaws contain certain mandatory retirement and resignation provisions that apply to members of our Board of Directors. Specifically, a director will be deemed to have retired and resigned from the Board of Directors effective immediately prior to the first annual meeting of stockholders occurring after such director attains seventy-two years of age. However, with respect to members of the Board of Directors who were serving as of February 4, 1999, this retirement and resignation applies once such director reaches seventy-five years of age. Additionally, the Board of Directors has the power to waive the application of these provisions on a case-by-case basis by affirmative vote of two-thirds of the directors after considering all of the applicable facts and circumstances. The Board of Directors has waived the application of such provisions with respect to Patrick Foley (who is seventy-eight years of age and was a member of the Board of Directors on February 4, 1999) and Thomas T. Farley (who is seventy-five years of age and also was a member of the Board of Directors on February 4, 1999) for one year. None of the other director nominees are affected by this mandatory retirement provision.

Our bylaws alsoCorporate Governance Guidelines generally provide that a director who has held officeshall serve for any perioda maximum of ninetwelve consecutive years after October 14, 2003, shall not be qualified to be elected as a director at the first annual meeting of stockholders

occurring after the end of such ninth consecutive year and shall be deemed to have retired and resigned from the Board of Directors effective immediately upon the completion of such ninth consecutive year in office;years; provided however, that the Board of Directors shall have the powermay make exceptions to waive the application of such provisions to a given directorthis term limitation on a case-by-case basis by an affirmative vote of two-thirds of the directors after considering all of the applicable facts and circumstances. Thiscircumstances (the “Term Limit Policy”). The commencement date for the Term Limit Policy is October 15, 2003 for non-employee directors who were members of the Board of Directors on such date. The term limit provision doeshas not affectimpacted any of the director nominees.

Director Nominees

At the Annual Meeting, stockholders will vote for tennine directors. Each director will be re-elected to hold office for a term of one year or until the 20112013 Annual Meeting of Stockholders. Each elected director will continue in office until such director’s successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Pursuant to our bylaws, based on the recommendation of the Governance Committee, our Board of Directors has designated the following tennine nominees for election. Each of the nominees has consented to serve as a director if elected. There are no family relationships among any directors.of the nominees or executive officers. The following table sets forth certain information with respect to the nominees:nominees, as of March 28, 2012:

Name | Age | Director Since | Principal Occupation or Employment | Position(s) with Health Net | Age | Director Since | Principal Occupation or Employment | Position(s) with Health Net | ||||||||||||

Mary Anne Citrino | 50 | 2009 | Senior Managing Director, The Blackstone Group | Director | 52 | 2009 | Senior Managing Director, The Blackstone Group | Director | ||||||||||||

Theodore F. Craver, Jr. | 58 | 2004 | Chairman, President and Chief Executive Officer of Edison International | Director | 60 | 2004 | Chairman, President and Chief Executive Officer of Edison International | Director | ||||||||||||

Vicki B. Escarra(2)(3) | 55 | 2006 | President and Chief Executive Officer of Feeding America | Director | 57 | 2006 | President and Chief Executive Officer of Feeding America | Director | ||||||||||||

Thomas T. Farley(1)(2)(4) | 75 | 1997 | Senior Partner of Petersen & Fonda, P.C. | Director | ||||||||||||||||

Gale S. Fitzgerald(1)(3) | 59 | 2001 | Former President and Director of TranSpend, Inc. and Director of various companies | Director | ||||||||||||||||

Patrick Foley(2)(3)(4) | 78 | 1997 | Former Chairman, President and Chief Executive Officer of DHL Airways, Inc. and Director of various companies | Director | ||||||||||||||||

Gale S. Fitzgerald(1)(4) | 61 | 2001 | Former Chair and Chief Executive Officer of Computer Task Group, Inc. | Director | ||||||||||||||||

Patrick Foley(2)(3) | 80 | 1997 | Former Chairman, President and Chief Executive Officer of DHL Airways, Inc. | Director | ||||||||||||||||

Jay M. Gellert | 56 | 1999 | Our President and Chief Executive Officer | President and Chief Executive Officer, Director | 58 | 1999 | Our President and Chief Executive Officer | President and Chief Executive Officer, Director | ||||||||||||

Roger F. Greaves | 72 | 1997 | Our Chairman of the Board, Former Co-Chairman, Co-President and Co-Chief Executive Officer and Director of various companies | Chairman of the Board | 74 | 1997 | Our Chairman of the Board, Former Co-Chairman, Co-President and Co-Chief Executive Officer of Health Systems International, Inc. | Chairman of the Board | ||||||||||||

Bruce G. Willison(2)(3)(4) | 61 | 2000 | Chief Executive Officer of Grandpoint Capital Advisors, Former Dean and Current Professor in Management, UCLA Anderson School of Management | Director | ||||||||||||||||

Frederick C. Yeager(1)(3) | 68 | 2004 | Advisor to Senior Management, Time Warner, Inc. | Director | ||||||||||||||||

Bruce G. Willison(3)(4) | 63 | 2000 | Dean Emeritus, UCLA Anderson School of Management | Director | ||||||||||||||||

Frederick C. Yeager(1)(4) | 70 | 2004 | Former Senior Vice President, Time Warner, Inc. | Director | ||||||||||||||||

| (1) | Current member of the Audit Committee |

| (2) | Current member of the Governance Committee |

| (3) | Current member of the Compensation Committee |

| (4) | Current member of the Finance Committee |

As set forth under “Meeting and Voting Information—Quorum and Votes Required,” in March 2010, the Board of Directors amended our bylaws to adoptinclude a majority voting standard for the election of directors in uncontested elections, such as this one. Accordingly, the persons receiving a majority of the votes cast by the shares present in person or represented by proxy at the Annual Meeting and entitled to vote shall be elected. Abstentions and broker non-votes will not be counted, and stockholders eligible to vote at the Annual Meeting do not have cumulative voting rights with respect to the election of directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR”FOR” the election of each of the tennine nominees named above. Because only tennine nominees have been named, proxies cannot be voted for a number of persons greater than tennine or for individuals other than those named as nominees in this proxy statement.

It is expected that the nominees named above will stand for election at the 20102012 Annual Meeting of Stockholders, but if any of the nominees declines or is unable to do so, the proxies will be voted for another person or persons designated by the Governance Committee of our Board of Directors.

The Board of Directors recommends a vote

“FOR” each named nominee.

Information Concerning Current Members of the Board of Directors and Nominees

Ms. Citrino has served as our director since December 2009. Ms. Citrino has been a Senior Managing Director in the Corporate Advisory Services group at The Blackstone Group, a global investment and advisory firm, since 2004. Ms. Citrino has served as a director of Dollar Tree, Inc., a NASDAQ Stock Market (NASDAQ)-listed company, since 2005, and is a member of its Audit Committee. Previously, Ms. Citrino was employed at Morgan Stanley for over 20 years. While at Morgan Stanley, she served as the Global Head of Consumer Products Investment Banking, Co-Head of Health Care Services Investment Banking, and as a Mergers and Acquisitions Analyst.

With

Our Board of Directors has concluded that, in light of her distinguished career inas an investment banking,banker, Ms. Citrino should serve as one of our directors because she provides our Board of Directors with a wealth of knowledge regarding business operations and business strategy, and the health care industry as well as valuable financial and investment expertise. HerFurther, her extensive experience identifying and valuing businesses provides our Board of Directors with key insights and knowledge of what makes our companyCompany work efficiently and effectively.

Mr. Craver has served as our director since March 2004. Mr. Craver has served as Chairman, President and Chief Executive Officer of Edison International, an electric power provider, since August 2008, and held several other positions at the company since 1996. Mr. Craver also is a current director of the Edison Electric Institute and the Electric Power Research Institute, both industry trade organizations,organizations. He is also the Co-Chairman of the Electric Drive Transportation Association, and a director of the Autry National Center, aboth of which are non-profit organization.organizations.

Some of the previous positions held by Mr. Craver at Edison International were: Chief Executive Officer of Edison Mission Group, one of its principal subsidiaries that owns and operates competitive power generation facilities, and Edison Capital, a provider of capital and financial services, from January 2005 to April 2008; Chief Financial Officer from January 2000 to December 2004; and in other financial and executive management positions beginning in 1996. From 1984 to 1996, Mr. Craver held various financial management positions at First Interstate Bancorp, including Executive Vice President and Corporate Treasurer of the holding company and Executive Vice President and Chief Financial Officer of a banking subsidiary. Mr. Craver served in various capital markets trading, underwriting and marketing positions at Bankers Trust Company of New York from 1980 to 1984 and at Security Pacific National Bank from 1973 to 1980.

Mr. Craver brings to our Board of Directors extensive senior executive management and financial experience at public companies. Mr. Craver gained his finance and accounting expertise as Chief Financial Officer of Edison International and during his banking career. Because of his broad financial experience, Mr. Craver serves as one of our SEC “audit committee financial experts” and provides our Board of Directors with valuable insight into finance and accounting related matters, as well as general management experience in large, complex and highly-regulated public companies. For these reasons our Board of Directors has concluded that Mr. Craver should serve as one of our directors.

Ms. Escarra has served as our director since July 2006. Since March 2006, Ms. Escarra has served as President and Chief Executive Officer of Feeding America, a non-profit organization focused on hunger-relief.

Ms. Escarra’s distinguished professional experience includes a 30-year career at Delta Air Lines, Inc., most recently having served as Delta Air Line’s Executive Vice President and Chief Marketing Officer from May 2001 until October 2004. Ms. Escarra was a director of A.G. Edwards, Inc. from 2002 to 2007 and is the former Chair of the Board of the Atlanta Convention and Visitors Bureau.

With over thirty years of business and consumer marketing experience, including at a large public company, our Board of Directors has concluded that Ms. Escarra should serve as one of our directors as she provides our Board of Directors with valuable business expertise, especially on matters relating to

marketing and business strategy. With her extensive business experience, Ms. Escarra understands the challenges of operating a public company in a dynamic and ever-changing business environment. Her present service leading a large non-profit organization lends a unique social awareness perspective to our Board of Directors.

Mr. Farley has served as our director since April 1997, having previously served as a director of HSI from January 1994 to April 1997. Mr. Farley is currently a senior partner in the law firm of Petersen & Fonda, P.C. in Pueblo, Colorado and serves on the Board of Governors of the Colorado State University System. Additionally, Mr. Farley is a current director/advisor of Wells Fargo Bank of Pueblo and Sunset, and a member of the Board of Regents of Santa Clara University, a Jesuit institution. Mr. Farley is also a director of the Finance Council of the Catholic Diocese in Southern Colorado and of Catholic Charities in Southern Colorado.

Previously, Mr. Farley served as a director of QualMed from February 1991 until February 1995. Mr. Farley also was formerly President of the governing boards of Colorado State University, the University of Southern Colorado and Ft. Lewis College and Chairman of the Colorado Wildlife Commission. He served as Minority Leader of the Colorado House of Representatives from 1967 to 1975. Mr. Farley was a director of the Public Service Company of Colorado, a public gas and electric company, from 1983 to 1997, and is a former director of Colorado Public Radio.

Mr. Farley’s distinguished career in a broad range of areas, including education, health care, public service and the private sector, provides our Board of Directors with experience and knowledge regarding regulatory, governance and legal matters. Mr. Farley’s long-standing history with the Board of Directors additionally provides continuity to the board and considerable understanding of the strategic and operational issues we face.

Ms. Fitzgerald has served as our director since March 2001. Ms. Fitzgerald is a director of Diebold, Inc., a New York Stock Exchange (NYSE)(“NYSE”)-listed company specializing in providing integrated self-service delivery systems and security systems and services, and is Chair of Diebold’s governance committee and a member of its compensation committee. Ms. Fitzgerald also is a director and a member of the audit committee of Cross Country Healthcare, Inc., a NASDAQ-listed healthcare staffing company.

From March 2003 to December 2008, Ms. Fitzgerald served as President and Director of TranSpend, Inc., a privately held company focusing on total spend optimization. From July 2002 through October 2002, Ms. Fitzgerald served as President and Chief Executive Officer of QP Group, a procurement solutions company. From October 1994 to June 2000, Ms. Fitzgerald served as Chair and Chief Executive Officer of Computer Task

Group, Inc., an international information technology services firm. Prior to this, Ms. Fitzgerald worked at International Business Machines Corporation, a world leader in information technology, where she held a variety of positions over the course of an eighteen year career, most recently as Vice President of Professional Services. Ms. Fitzgerald also served on the Board of Directors of Kaleida Health System in Buffalo, New York from 1995 to 2002, and was Vice Chair from 2000 to 2002, and served on the Advisory Board of the University of Buffalo’s School of Management from 1993 to 2001. Ms. Fitzgerald served on the Boards of Directors of the Information Technology Services (“ITS”) Division of Information Technology Association of America (“ITAA”) and of ITAA from 1992 to 2002, and was Chair of the ITS Board from 1998 to 2002.

With her distinguished career as a senior executive in the information technology industry, Ms. Fitzgerald provides our Board of Directors with expertise in information technology, supply chain management, procurement solutions, human resources, strategic planning, operations management, marketing and healthcare. In addition, serving on the boards of Diebold and Cross Country Healthcare, Ms. Fitzgerald draws from extensive directorial and governance experience, which enables her to contribute valuable insight and guidance on important issues facing Health Net. Based on these reasons, our Board of Directors has determined that Ms. Fitzgerald should serve as one of our directors.

Mr. Foley has served as our director since April 1997.Mr. Foley served as a director of FHC from 1996 until the FHS Combination in April 1997. Mr. Foley served as Chairman, President and Chief Executive Officer of DHL Airways, Inc., an air express parcel delivery company, from September 1988 through July 1999. Prior to this, Mr. Foley worked at Hyatt Hotels Corporation for 26 years, where he held senior management positions, including Chairman and President from 1977 to 1988 and Chief Operating Officer from 1972 to 1977. From 1984 until 1988, Mr. Foley also served as Chief Executive Officer of Braniff Airlines.

With a distinguished career including more than 30 years of experience in the hotel and airline industries as well as service on the boards of several other public companies, including Continental Airlines, Del Monte Foods Company, Flextronics International Ltd., Greyhound Lines, Inc., Copart, Inc. and Glenborough Realty Trust, Inc., Mr. Foley provides our Board of Directors with demonstrated leadership skills, expertise in business and management and extensive directorial experience. AsFurther, as one of our longest standing directors, Mr. Foley also provides continuity to the board, institutional knowledge and a deep understanding of the strategic and operational issues we face. For these reasons, our Board of Directors has concluded that Mr. Foley should serve as one of our directors.

Mr. Gellert has served as our director since February 1999 and has served as our President and Chief Executive Officer since August 1998. Mr. Gellert has been a director of Ventas, Inc., a NYSE-listed company, since August 2001. Mr. Gellert also is currently Chairmana member of the Board of Directors of America’s Health Insurance Plans, a national association representing over one thousand health insurance companies.

Previously, Mr. Gellert served as our President and Chief Operating Officer from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as our Executive Vice President and Chief Operating Officer. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.’s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, he was Senior Vice President and Chief Operating Officer for California Healthcare System.

Our Board of Directors has determined that Mr. Gellert’sGellert should serve as one of our directors due to his distinguished career in the managed care industry and as a senior executive, which provides our Board of Directors with demonstrated leadership capabilities and expertise in business, management and the health care industry. As a senior executive of our Company since 1997 and our predecessor during 1996, Mr. Gellert brings in-depth operational knowledge and understanding of all facets of our business. In addition, as our President and Chief Executive Officer, he serves as a valuable bridge between management and the board, ensuring that both groups act with a common purpose. Mr. Gellert’s extensive knowledge of our operations and the markets in

which we compete, combined with his experience on the board of another NYSE-listed company, enables him to identify important matters for board review and deliberation.

Mr. Greaveshas served as our director since April 1997 and was elected Chairman of the Board of Directors in January 2004. Mr. Greaves serves as an Honorary Member of the Board of Trustees of California State University at Long Beach.

Mr. Greaves served as a director of HSI from January 1994 until the FHS Combination in April 1997. Mr. Greaves served as our Co-Chairman of the Board of Directors, Co-President and Co-Chief Executive Officer from January 1994 (upon consummation of the HSI Combination) until March 1995. Prior to January 1994, Mr. Greaves served as Chairman of the Board of Directors, President and Chief Executive Officer of H.N. Management Holdings, Inc., a predecessor to Health Net (“HN Management Holdings”), since its incorporation in June 1990. Prior to this, Mr. Greaves served as the President and Chief Executive Officer, from February 1982 until the incorporation of HN Management Holdings in June 1990, and additionally as Chairman, from September 1989 until the incorporation of HN Management Holdings in June 1990, of Health Maintenance Network of Southern California (the predecessor to H.N. Management Holdings). Mr. Greaves currently serves as Chairman of the Board of Directors of Health Net of California, Inc. (“HN California”), our subsidiary. Mr. Greaves also served a prior term as Chairman of the Board of Directors of HN California, and concurrently served as President and Chief Executive Officer of HN California. Prior to joining HN California, Mr. Greaves held various management roles at Blue Cross of Southern California, including Vice President of Human Resources and Assistant to the President, and held various management positions at Allstate Insurance Company from 1962 until 1968.

With a distinguished career of over forty years of management experience in key leadership roles, including as former Chief Executive Officer of our Company and its predecessors in interest, Mr. Greaves brings to our Board of Directors has concluded that Mr. Greaves possesses demonstrated leadership capabilities and in-depth knowledge of our history and all aspects of

our business.business and, therefore, he should serve as one of our directors. His extensive management experience and knowledge and understanding of our business and operations combine to provide our Board of Directors with valuable guidance and input on the many strategic and operational issues we face. In addition, having served on several boards of directors, Mr. Greaves has considerable governance experience that he contributes to board discussions and deliberations.

Mr. Willisonhas served as our director since December 2000. Mr. Willison currently serves as Chief Executive Officer of Grandpoint Capital Advisors, a middle market investment bank, a position he has held since January 2009. Mr. Willison also is a director of Move, Inc., a NASDAQ-listed company, Grandpoint Bank, a community bank in Los Angeles, and a trustee of SunAmerica’s Seasons and Series Trusts.

Mr. Willison served as Dean, UCLA Anderson School of Management (the “UCLA Anderson School”) from July 1999 to January 2007, and is currently a Professor in ManagementDean Emeritus of UCLA Anderson School of Management. From January 2009 until July 2010, Mr. Willison served as Chief Executive Officer of Grandpoint Capital Advisors, a middle market investment bank. Mr. Willison served as a director of IndyMac Bancorp, Inc. from July 2005 to July 2008. From April 1996 to October 1998, Mr. Willison served as President and Chief Operating Officer of H.F. Ahmanson, Inc. (Home Savings of America). Mr. Willison also served as Chairman, President and Chief Executive Officer of First Interstate Bank of California from February 1991 to April 1996.

Mr. Willison’s distinguished career in key leadership roles in the financial industries and as a professor and former Dean of the UCLA Anderson School of Management provides our Board of Directors with demonstrated leadership skills and expertise in business and finance. Mr. Willison’s governance experience on the boards of several publicly traded companies enables him to play a vital role in board discussions and deliberations regarding our business strategy and operations. In addition, as a director since 2000, Mr. Willison understands our history, business and the complex industry in which we compete. Therefore, for these reasons our Board of Directors has determined that Mr. Willison should serve as one of our directors.

Mr. Yeagerhas served as our director since March 2004. Mr. Yeager has served in numerous senior positions at Time Warner, Inc., a NYSE-listed media and entertainment company since Mayfrom 1995 includingto 2011. Mr. Yeager served as an advisor to Time Warner’s senior management sincefrom August 1, 2009 Senior Vice President, Finance since December 2000, and Chairman of the Time Warner’s Investment Committee and trustee of Time Warner’s U.K. Pension Plans since 2005.to August 2011.

From December 2000 to January 2009, Mr. Yeager led teams responsible for global strategic sourcing, supplier diversity, and investment of employee benefits assets, and served as the chair of the Time Warner Investment Committee. From May 1995 to December 2000, Mr. Yeager was Vice President, Finance and Development for Time Warner and led teams responsible for financial and business planning, mergers and acquisitions, treasury, capital structure planning and capital markets transactions, and for managing Time Warner’s relationships with commercial and investment banks and debt-rating agencies. Prior thereto, Mr. Yeager had a 27-year career with Ford Motor Company where he held executive and management positions in the Finance Staff, the Treasurer’s Office, theand Treasury departments, Product Development Group, theand Financial Services Group,groups, Ford of Europe, and Ford Motor Credit Company. Mr. Yeager began his career at Ford in 1968 as an Operations Research Analyst.

Our Board of Directors has concluded that Mr. Yeager’sYeager should serve as one of our directors due to his distinguished career working in finance, planning, treasury and capital markets and experience as a senior executive and advisor for large corporations, which provides our Board of Directors with extensive knowledge of complex financial and operational issues facing large organizations. Mr. Yeager’s expertise in dealing with accounting principles and financial reporting rules and regulations provides him with the financial acumen requisite to serve as one of our SEC “audit committee financial experts” and makes him well suited to serve on our Audit Committee. His years of business experience combined with his financial and business planning expertise play a vital role, especially in light of current market conditions, in board discussions and deliberations regarding our financial strategy.and business strategies.

The following sets forth certain biographical information with respect to our executive officers, as of March 31, 2010, and all individuals who served as our executive officers during 2009.the date of this proxy statement.

Name | Age | Position | ||||

Jay M. Gellert | 58 | President and Chief Executive Officer | ||||

James E. Woys | 53 | Executive Vice President, Chief Operating Officer | ||||

Joseph C. Capezza, CPA | 56 | Executive Vice President, Chief Financial Officer and Treasurer | ||||

Angelee F. Bouchard | 43 | Senior Vice President, General Counsel and Secretary | ||||

Patricia T. Clarey | 58 | Senior Vice President, Chief Regulatory and External Relations Officer | ||||

| 50 | Senior Vice President, Customer and Technology Services | ||||

Karin D. Mayhew | 61 | Senior Vice President, | ||||

Steve Sell | 45 | President, Western Region Health Plan | ||||

John P. Sivori | 48 | Health Care Services Officer President of Regional Health Plans and Health Net Pharmaceutical Services | ||||

| ||||||

Steven D. Tough | 61 | President, Government Programs | ||||

Mr. Gellert. See “—“Item 1—Election of Directors—Information Concerning Current Members of the Board of Directors and Nominees” above.

Mr. Woys has served as our Executive Vice President, Chief Operating Officer since November 2007. Previously, Mr. Woys served as our Interim Chief Financial Officer from November 2006 until November 2007, and served as President, Government and Specialty Services from October 2005 until November 2007. Prior thereto, he served as President of Health Net Federal Services from February 2001 to October 2005. Mr. Woys served as Chief Operating Officer and President of Health Net Federal Services from November 1999 to February 2001. Mr. Woys served as Chief Operating Officer and Senior Vice President for Foundation Health Federal Services from February 1998 to November 1999. Mr. Woys served as Senior Vice President of Foundation Health Federal Services from January 1995 to February 1998. From January 1990 to January 1995, Mr. Woys served as Vice President and Chief Financial Officer of the Government Division of FHC. Mr. Woys served as Director of Corporate Finance/Tax for FHC from October 1986 to January 1990. Prior to Mr. Woys’ employment with FHC, he was employed by Price Waterhouse from 1982 to 1986 and by Arthur Andersen & Co. from 1980 to 1982.

Mr. Capezza has served as our Executive Vice President, Chief Financial Officer since November 1, 2007.2007, and as Treasurer since April 1, 2012. Prior to joining Health Net, Mr. Capezza served as Chief Financial Officer at Harvard Pilgrim Health Care from January 2002 to October 2007. From June 2000 to December 2001, Mr. Capezza served as Senior Vice President and Chief Financial Officer at Group Health Incorporated. Prior thereto, Mr. Capezza had a long career with Reliance Insurance Group, where he served as Senior Vice President and Chief Financial Officer at Reliance Reinsurance Corp. from February 1990 to May 2000. From 1985 to 1990, Mr. Capezza served as Vice President and Chief Financial Officer at Willcox Incorporated Reinsurance Intermediaries, and from 1983 to 1985, Mr. Capezza served as Vice President and Controller at Skandia America Reinsurance Company. From 1976 to 1983, Mr. Capezza served as General Practice Manager—Insurance Industry Specialist at Coopers & Lybrand, LLP.

Ms. Bouchardhas served as our Senior Vice President, General Counsel and Secretary since December 14, 2009, having joined Health Net as Vice President, Assistant General Counsel and Assistant Secretary in 2003. Prior to joining Health Net, Ms. Bouchard was an associate at the law firm of Latham & Watkins LLP from 1996 until 2003, during which time she specialized in capital markets transactions, mergers and acquisitions and public company representation.

Ms. Clareyhas served as our Senior Vice President, Chief Regulatory and External Relations Officer since June 2008. Previously, Ms. Clarey served as Chief Operating Officer of our Health Plan Division and Health Net of California from April 2006 through May 2008. In 2003, Ms. Clarey left us to serve as a member of the senior

leadership team for the campaign for Arnold Schwarzenegger for Governor of California, and after his election served as Governor Schwarzenegger’s Chief of Staff. Prior thereto, from March 2001 to November 2003, Ms. Clarey served as our Vice President of Government Relations. Prior to her service at Health Net, from 1998 through 2001 Ms. Clarey held senior management positions at Transamerica Corporation, and from 1991 to 1998 she served as deputy chief of staff to former California Governor Pete Wilson. Ms. Clarey is currentlya member of the State Personnel Board and a director of California Public Employees’ Retirement System, State Personnel Board andthe California Foundation on the Environment and the Economy.

Mr. Lynchserved as our President, Health Plan Division from November 2007 until November 8, 2008. On November 8, 2008, Mr. Lynch announced he would retire from the Company effective February 28, 2009. From November 2008 until February 28, 2009, Mr. Lynch served as our Special Advisor, Health Plan Division. Previously, Mr. Lynch served as our President, Regional Health Plans since January 2005. Prior thereto, Mr. Lynch served as Chief Operating Officer for our Western Region since June 2004. Mr. Lynch served as President, Health Net of Oregon from August 2001 to June 2004.

Ms. MayhewHefnerhas served as our Senior Vice President, Customer and Technology Services, which is our chief customer services officer, since January 2012. Prior thereto, Ms. Hefner served as our Chief Customer Services Officer since September 2010. In addition, since 2008, Ms. Hefner has also served as President and Chief Executive Officer of MHN, our subsidiary that offers behavioral health, substance abuse and employee assistance programs. Prior to assuming the role of President and Chief Executive Officer of MHN, Ms. Hefner was Chief Operating Officer for MHN from 2007. From August 1999 to 2007, Ms. Hefner held several vice president positions within Health Net.

Ms. Mayhewhas served as our Senior Vice President, Organization Effectiveness since April 1999. Prior to joining us, Ms. Mayhew served as Senior Vice President, Organization Development of Southern New England Telecommunications Company (“SNET”), a northeast regional information, entertainment and telecommunications company based in Connecticut. Prior thereto, Ms. Mayhew served in various capacities at SNET, including Vice President, Human Resources, since 1972.

Mr. Sell has served as our President, Western Region Health Plan since December 2009, having previously served as President of Health Net of California since November 2008. Prior to assuming the role of President of Health Net of California, Mr. Sell was President and Chief Executive Officer of Managed Health Network, Inc. (“MHN”), our subsidiary that offers behavioral health, substance abuse and employee assistance programs,MHN from December 2006 to November 2008, our Chief Sales Officer from March 2006 to December 2006, and our Vice President, Employer Services Group from January 2004 to March 2006. Mr. Sell served as a consultant with Booz Allen Hamilton prior to joining Health Net.

Mr. Sivori has served as our Health Care Services Officer since December 2009 and our President of Regional Health Plans and Health Net Pharmaceutical Services since November 2008. Previously, Mr. Sivori served as our President of Health Net Pharmaceutical Services from September 2001 to November 2008. Prior thereto, Mr. Sivori was appointed Senior Vice President and Chief Financial Officer of Integrated Pharmaceutical Services, now Health Net Pharmaceutical Services, from December 1998 until September 2001. Mr. Sivori originally joined FHC in August 1994 and held various senior management positions prior to December 1998.

Ms. Tianohas served as our President, Regional Health Plans, Health Net of the Northeast, Inc. since December 14, 2009, having previously served as our Senior Vice President, General Counsel and Secretary since February 1, 2007. Ms. Tiano served as Senior Vice President and General Counsel for WellChoice, Inc., the parent of Empire Blue Cross and Blue Shield of New York, from September 1995 to December 2005. Following WellChoice’s acquisition by WellPoint, Inc. in late 2005, Ms. Tiano served as Vice President and Deputy General Counsel for the East Region and National Accounts for WellPoint until November 1, 2006. Before WellChoice, Ms. Tiano was Vice President and General Counsel of MVP Health Plan in New York (“MVP”) from August 1992 to September 1995. Prior to MVP, Ms. Tiano was a partner in the New York office of Epstein Becker & Green.

Mr. Toughhas served as our President, Government Programs since January 16, 2010, our President of Health Plan and Government Programs since November 2008, the President of Health Net Federal Services since January 2006, and our President of our Government and Specialty Services division since February 2008. From 1978 to 1998, Mr. Tough spent 20 years at FHC, nine of which he served as President and Chief Operating Officer of our Government and Specialty Services groups. Upon leaving FHC in 1998, and prior to joining us in 2006, Mr. Tough started his own firm providing health care consulting services to a variety of companies, and served as President and Chief Executive Officer of the California Association of Health Plans and President, Western Region, MAXIMUS Health Care Services Group, a health care services organization.

Certain Relationships and Related Party Transactions

We have adopted a written Related Party Transaction Policy (the “Policy”), which Policy has been approved by the Audit Committee of the Board of Directors (“Audit Committee”) in accordance with its charter. The Policy outlines our policies and procedures for the review, approval or ratification of certain transactions in which any of our related parties had or will have a direct or indirect material interest. For purposes of the Policy, a “related party” means any of our directors or director nominees, our executive officers, holders of more than five percent (5%) of any class of our voting securities, or any member of the immediate family of any of the foregoing persons, hadany firm, corporation or will haveother entity in which any of the foregoing persons is employed or is a directpartner or indirect material interest.principal or in a similar position, or in which any number of the foregoing persons hold in the

aggregate a 10% or greater beneficial ownership interest, or any charitable, tax exempt or non-profit organization in which any of the foregoing persons is actively involved in fundraising or otherwise serves as a director, officer, trustee, or any similar capacity. The Policy provides, among other things, for any proposed related party transaction to be submitted to the Audit Committee, or under delegated authority to the Chair of the Audit Committee (the “Chair”), for approval. The factors to be considered by the Audit Committee, or Chair, as applicable, when reviewing such related party transaction shall include, but are not limited to, the following: (i) the benefits to Health Net;Net of the transaction; (ii) the impact on a director’s independence in the event the related party is a member of the Board of Directors, an immediate family member of a member of the Board of Directors or an entity in which a member of the Board of Directors is a partner, shareholder, trustee, director, executive officer or executive officer;similar position; (iii) the availability of other sources for comparable products or services; (iv) the terms of the transaction; and (v) the terms available to unrelated third parties or to employees generally.

The Policy also provides that if we find that a related party transaction is ongoing that did not receive prior approval by the Audit Committee, or Chair, as applicable, then such transaction will be promptly submitted to the Audit Committee or Chair for consideration of all of the relevant facts and circumstances available, and taking into account the same factors as described above, to determine whether the transaction should be ratified, amended or terminated. If a related party transaction is completed that did not receive prior approval, the Audit Committee or Chair, as applicable, shall evaluate the transaction, taking into account the same factors as described above, to determine if rescission of the transaction is appropriate. In the case of an ongoing or completed related party transaction that did not receive prior approval in accordance with the Policy, the General Counsel shall evaluate our controls and procedures to ascertain the reason(s) the transaction was not submitted for prior approval and whether any changes to these procedures are recommended. The Chair shall report to the Audit Committee at the next Audit Committee meeting any approval, ratification, amendment or rescission of a related party transaction made by such Chair under his or her delegated authority pursuant to the Policy.

On March 28, 2007, theThe Audit Committee, in accordance with the Policy, pre-approved a transaction with Jonathan Mayhew,has reviewed, approved and/or ratified the following transactions:

The step-son of our Senior Vice President of Organization Effectiveness. Mr.Effectiveness, Karin Mayhew, is the President and an equity owner of two limited liability companies (the “LLCs”), holding a fifty percent equity interest in the firstone LLC and a five percent equity interest in the second LLC. The LLCs entered into a contract with Health Net to provide certain disability advocacy services, professional Social Security Disability Insurance and Medicare identification and advocacy services to eligible health plan members, for which we paid approximately $469,200$434,750 in fees for the year ended December 31, 2009. Mr. Mayhew was directly involved in negotiating the contracts on behalf of the LLCs. Our2011.

During 2011, Health Net had an agreement with the LLCs was amended in 2009. This amendment was brought to the attentionBlackRock Capital Management, Inc., which is a subsidiary of the Audit Committee in accordance with the Policy.

On March 17, 2010, the Audit Committee, in accordance with the Policy, approved a transaction with BlackRock, Inc., a holder of more than five percent of the Company’sHealth Net’s outstanding common stock as reported on a Scheduleaccording to Schedules 13G filed withon each of February 4, 2011 and February 13, 2012. Under the SEC on January 29, 2010.terms of the agreement, BlackRock FinancialCapital Management Inc., a subsidiary of BlackRock, Inc., providesprovided investment management services for us for a portion of 2011, for which we paid approximately $1,220,254$344,380 in fees that year (a portion of which consisted of fees paid for services rendered to us in 2010). As of March 2011, BlackRock Capital Management no longer provides any investment management services to us.

Linda Tiano, who served as one of our executive officers during 2011 and until March 2, 2012, married a partner of the law firm of Epstein Becker & Green, P.C. (“EBG”) in April 2011. In 2011, we paid EBG approximately $664,235 for legal services.

During 2011, Health Net had an agreement with Wellington Management Company, LLP (“Wellington”), a holder of more than five percent of Health Net’s outstanding common stock according to Schedules 13G filed on each of February 14, 2011 and 2012. Under the terms of the agreement, Wellington provided investment management services to Health Net for a fee based on the amount of assets under management, which fee was approximately $325,023 for the year ended December 31, 2009.2011.

Corporate Governance Guidelines and Code of Conduct

Members of our Board of Directors are elected by the holders of our Common Stock and represent the interests of all stockholders. Our Board of Directors meets periodically to review significant developments affecting us and to act on matters requiring its approval. Although the Board of Directors delegates selected matters to others, subject to its ultimate oversight, it reserves certain powers and functions to itself.

Our Board of Directors has established Corporate Governance Guidelines that it follows in matters of corporate governance. In addition, the Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, directors and officers, including our principal executive officer, principal financial officer and principal accounting officer. In addition, our Code of Business Conduct and Ethics provides that our “First Tier and Downstream Related Entities,” as defined by Medicare regulations, must abide by the Code of Business Conduct and Ethics if they do not have their own Code of Conduct and policies that comply with applicable laws and regulations. Our Corporate Governance Guidelines and Code of Business Conduct and Ethics are published on our Web sitewebsite atwww.healthnet.com. We intend to disclose any future amendments to certain provisions of our Code of Business Conduct and Ethics, or waivers of provisions required to be disclosed under the rules of the SEC or listing standards of the NYSE, at the same location on our website identified above.

Board Meetings and Committees; Annual Meeting Attendance

Our Board of Directors met a total of seventeeneleven times in 2009.2011. Each member of our Board of Directors was present for 75% or more of the combined total of (i) all meetings of the Board of Directors held in 2009 (during the period he/she served as a director)2011 and (ii) all meetings of all committees of the Board of Directors held in 20092011 on which he/she served (during the period he/she served).served. Our non-management directors meet in executive session without management on a regularly scheduled basis, but not less frequently than quarterly. The non-executive Chairman presides at such executive sessions, or in his absence, a non-management director designated by our non-executive Chairman. In addition, it is our policy that each of our directors attends the Annual Meeting. All of our current directors were in attendance at the 20092011 Annual Meeting.Meeting of Stockholders.

Director Independence

On an annual basis, with the assistance of the Governance Committee, our Board of Directors reviews the independence of all directors and affirmatively makes a determination as to the independence of each director. To assist in making this determination, the Board of Directors has adopted independence guidelines (the “Director Independence Standards”), which are designed to conform to, or be more exacting than, the independence requirements set forth in the listing standards of the NYSE. The director independence guidelinesDirector Independence Standards are published on our Web sitewebsite atwww.healthnet.com. In addition to applying these guidelines, the Board of Directors considers any and all additional relevant facts and circumstances in making an independence determination.

Our Board of Directors has determined that the following directors qualify as independent under NYSE listing standards: Mary Anne Citrino, Theodore F. Craver, Jr., Vicki B. Escarra, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Roger F. Greaves, Bruce G. Willison and Frederick C. Yeager. Under the NYSE listing standards, no director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with us,the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with us.the Company, that would impair such director’s independence. The Board of Directors has affirmatively determined that each of Mary Anne Citrino, Theodore F. Craver, Jr., Vicki B. Escarra, Gale S. Fitzgerald, Patrick Foley, Roger F. Greaves, Bruce G. Willison and Frederick C. Yeager is an independent member of the Board of Directors under the listing standards of the NYSE and the Director Independence Standards and has no material relationship with the Company that would impair such director’s independence. In making such determination the Board of Directors considered the current and past relationships, if any, between Health Netthe Company and members of the Board of Directors or their immediate family members.

Additionally, the Board of Directors reviewed and considered the following transactions and relationships:

With respect to Ms. Citrino, Health Net made certain expense reimbursementspayments in the ordinary course of business to three portfolio companies of The Blackstone Group in exchange for their provision of certain health care services during 2011. Based on the amounts paid by Health Net to membersportfolio companies of The Blackstone Group and the nature of the relationship (including the absence of any material relationship between Ms. Citrino and Health Net outside of her service as a member of our Board of Directors), our Board of Directors determined that Ms. Citrino is independent.

With respect to Messrs. Craver and Yeager, entities with which these directors are or theirwere employed during 2011 paid health insurance premiums to Health Net during 2011. Based on the amounts of such payments and the nature of the relationships (including the absence of any material relationship between Health Net and either Mr. Craver or Mr. Yeager, respectively, outside of service as a member of our Board of Directors), our Board of Directors determined that Messrs. Craver and Yeager are independent.

With respect to Mr. Craver, Health Net made provider payments in the ordinary course of business to an entity that employed an immediate family membersmember of Mr. Craver. Because Mr. Craver’s immediate family member is not an executive officer of the entity, and based on the amounts paid by such entity to Health Net and the nature of the relationship (including the absence of any material relationship between Mr. Craver and Health Net outside of his service as a member of our Board of Directors), which were our Board of Directors determined that Mr. Craver is independent.

With respect to be either directly relatedMr. Willison, Health Net made certain payments in the ordinary course of business during 2011 to a bona fide business purposehospital associated with a nonprofit entity of which Mr. Willison’s spouse is a member of the board of trustees. Health Net did not make any payments or immaterialdonations to the nonprofit entity. Because Mr. Willison’s spouse is not an executive officer of the hospital to which Health Net made payments in amount.2011 and due to the nature of the relationship (including the absence of any material relationship between Mr. Willison and Health Net outside of his service as a member of our Board of Directors), our Board of Directors determined that Mr. Willison is independent.

In determining that Mr. Greaves is independent, the Board of Directors considered the following additional factors: (i)

Mr. Greaves’ prior employment with Health Net,the Company, which ended more than fourteensixteen years ago; (ii)

the lifetime health benefits from Health Netthe Company (or any successor) that Mr. Greaveshe and his spouse received in conjunction with his retirement from Health Netthe Company as an employee; and (iii)

the fact that Mr. Greaves was reimbursed for certain expenses in connection with his travel to, and attendance at, certain business related meetings and events as a Company representative;

the fact that Mr. Greaves’ wife serves as a non-paid volunteer with Celebration of Children, a Health Net-sponsoredCompany-sponsored charity, and Heart & Soul, a Company awards program, and receives certain expense reimbursements related to such service. service; and

the fact that Mr. Greaves was reimbursed for certain travel related expenses incurred by his wife while, and in conjunction with, attending or accompanying him to meetings and events unrelated to Celebration of Children and Heart & Soul.

In light of the significant time period since Mr. Greaves’ resignation and the fact that his receipt of health benefits is in no way contingent upon continued service to Health Net,the Company, the business purpose of the expense

reimbursements andto Mr. Greaves, the fact that Mrs. Greaves receives no salary compensation (only reimbursement of documented expenses) for her service to Celebration of Children and Heart & Soul, and the nature and amount of the reimbursements to Mr. Greaves for expenses incurred by his wife while, and in conjunction with, traveling

with him to business related meetings and events, the Board of Directors determined that these were not material relationships under NYSE listing standards and therefore determined Mr. Greaves to be independent under such standards.

Committees of the Board of Directors

Our bylaws establish the following standing committees of the Board of Directors: the Audit Committee, the Governance Committee, the Compensation Committee and the Finance Committee. Our bylaws further provide that additional committees may be established by resolution adopted by a majority of the Board of Directors. From time to time, the Board of Directors establishes various ad hoc committees by resolution. A majority of the Board of Directors selects the directors to serve on the committees of the Board of Directors upon recommendation of the Governance Committee.

Audit Committee.

The Audit Committee of our Board of Directors currently consists of Messrs. Yeager (Chairperson) and Craver (Chairman), Farley, Yeager and Ms. Fitzgerald. Each of the current members of the Audit Committee served on the Audit Committee from January 2009 to December 2009.during 2011. Our Board of Directors has determined that all current Audit Committee members are financially literate under the NYSE listing standards and that all current members of the Audit Committee are independent under NYSE listing standards and under the requirements of SEC Rule 10A-3. Messrs. Craver and Yeager have each been determined by the Board of Directors to be an “audit committee financial expert,” as defined by SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002. Our Audit Committee held elevennine meetings in 2009.2011.

Audit Committee Responsibilities. The Audit Committee is governed by a charter, a current copy of which is available on our Web sitewebsite atwww.healthnet.com. Pursuant to the Audit Committee charter, the Audit Committee is responsible for, among other things:

appointing, compensating, retaining, terminating and overseeing the work of any registered public accounting firm (“independent auditors”) engaged to prepare or issue an audit report or perform other audit or non-audit services for us;

pre-approving our annual engagement letter with the independent auditors and all audit services and permitted non-audit services, including the proposed fees related thereto, to be performed for us by the independent auditors;

reviewing the performance of the independent auditors, including the lead partner of the independent auditors;

obtaining and reviewing, at least annually, a report from the independent auditors with respect to matters affecting the independent auditors’ internal quality-control procedures, independence and other material issues surrounding the auditing process;

evaluating the independence of the independent auditors;

reviewing and discussing with the independent auditors their annual audit plan, (for annual and quarterly reporting purposes), including the timing and scope of audit activities, and monitoring such plan’s progress and results during the year;

reviewing with management and the independent auditors our practicesinformation which is required to be reported by the independent auditors under SEC rules and regulations;

reviewing and discussing with respect to, among other things:management and the disclosures inindependent auditors our annual audited financial statements and quarterly financial statements;statements, including our specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and any major issues related thereto;

reviewing with management and the process surrounding certain accounting estimates;independent auditors, among other things: treatment of significant transactions not a part of our regular operations; significant adjustments to our financial statements proposed or pass on by the independent auditors; the process surrounding certain accounting estimates; significant issues concerning litigations, contingencies, claims or assessments and material accounting issues that require disclosure in the financial statements; risk assessment; risk management;major issues regarding accounting principals

and financial statement presentations; analyses prepared by management and/or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements; and the effect of regulatory and accounting initiatives on the financial statements; |

reviewing with management and the independent auditors, as applicable, the information to be included our critical accounting policies; and oversight of defined, statutory financial filings as required by regulatory guidance;earnings press releases;

reviewing and resolving all disagreements problems or difficulties between our independent auditors and management regarding financial reporting;reporting and regularly reviewing with our independent auditors any problems or difficulties encountered in the course of any audit work;

appointing, retaining, dismissing, compensating and overseeing our internal auditors;

periodically reviewing the charters of the internal audit function, the Audit Committee’s involvement and reporting tointeraction with the Board of Directors oninternal auditors, the performanceinternal audit risk assessment and internal audit plan with management and the independenceinternal auditors, and the responsibility of, performance of and services provided by the independentinternal auditors;

reviewing on a regular basis,the progress and results of all internal audit projects with management and the internal auditors, and, when necessary, assigning or directing management to assign additional audit projects to the internal auditors;